Applying for a loan to buy, build or start a childcare business--or refinancing an exiting loan--requires the preparation of sufficient information for the lender to evaluate the likelihood that future business profits can repay the loan.

The best-prepared business owner starts organizing their loan application package with all of the requested information requested so to expedite lender underwriting.

Based on experience in hundreds of business loans, here's my list of suggested documents to compile an application package for funding a childcare business:

1. Business plan

Writing a solid business plan may be most important function you perform when preparing to buy, build or start a business and will make the application process easier to navigate, since you'll have the documents gathered and be prepared to answer the lender's questions.

Click here to download my brief Business Plan Guide for the best practices to write the most effective business plan.

2. Educate lender about the childcare industry

For the lender's benefit, make sure your business plan includes a full explanation of the nature of the childcare business, detailing the specific conditions that have led to your business decisions and loan application, such as:

- The market where you plan to operate and demographic information that will impact your business.

- Competitors who provide childcare services in the area and comparative information about their licensed capacity, pricing, and their current enrollment.

Click here to download my Childcare Site Visit form for a starting list of information needed about prospective acquisitions (and future competitors when possible).

3. Other company information your lender requires:

- Financial statements (balance sheet & profit/loss statement) for past three years.

- Interim YTD financial statement no more than 90 days old and a comparative statement from the same date in the previous year.

- Business Debt Schedule, detailing all of the loans and leases to your company, as of the date of the interim financial statement (get form here).

- Business income tax returns for past three years.

- IRS Form 4506-T required for lender to obtain transcripts of your income tax return (get form here).

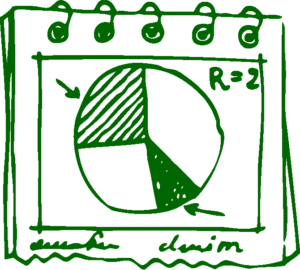

- Profit & Loss statement projections for the next three years, along with a month-to-month Cash Flow projection for the first year. Your forecast will be taken more seriously if you provide written assumptions used to construct them, such as the number of children enrolled each period, salary/wage information, etc.

- Projected balance sheet for operations beginning after loan closing.

- Personal financial statement (Get SBA Form 431 here).

- Copies of bank account statements for at least two months confirming funds for your personal investment.

- Personal income tax returns for past three years.

- IRS Form 4506-T required for lender to obtain transcripts of your income tax return (get form here).

Let's Get Started

Whether you're writing a business plan or just signed a contract, it's never too early to begin working on your loan proposal. Let's talk about your project soon.